User’s Guide to Optimizing Mining Technology for Profitable Crypto Mining Ventures

In the ever-evolving landscape of cryptocurrencies, mining remains a critical backbone of the blockchain ecosystem. Yet, as the digital currency market grows and matures, so too does the complexity associated with mining. For those keen on diving into this world or enhancing their operations, understanding how to optimize mining technology can significantly bolster profitability. This guide aims to equip miners with strategies to make the most of their ventures.

At its core, cryptocurrency mining entails validating transactions and consequently securing a blockchain network. This process requires substantial computational power, which translates to the need for robust mining rigs. When selecting hardware, miners must consider various factors, including hashing power, energy efficiency, and scalability. As Bitcoin (BTC) remains the dominant player in the market, miners must particularly focus on devices optimized for SHA-256, Bitcoin’s hashing algorithm.

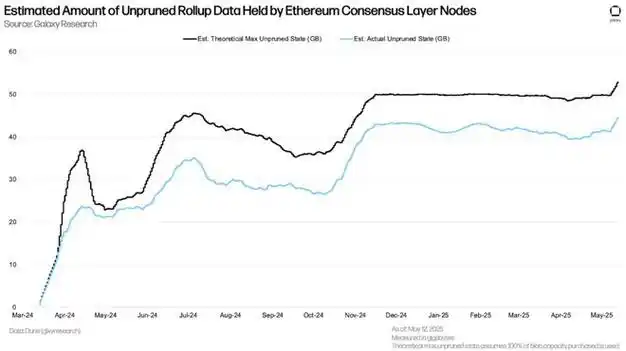

Yet, Bitcoin is not the only coin worth mining. Ethereum (ETH), with its move toward Proof of Stake and the introduction of Ethereum 2.0, presents a different set of opportunities and challenges. Miners need to stay abreast of the network’s changing mechanics. With Ethereum, the graphic processing units (GPUs) are the stars, as they effectively handle the complex calculations needed in the discovery of new blocks.

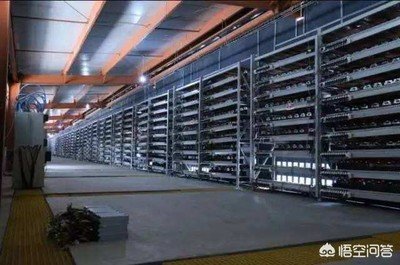

As the mining landscape diversifies, so do the strategies employed by miners, particularly when considering hosting options. Hosting mining rigs can ease the burden of managing equipment, reducing overhead costs like electricity and cooling. Opting for a reliable mining farm allows cryptocurrency enthusiasts to maximize their potential profits while minimizing risks. Locations with cheap electricity rates often become hotspots for these facilities, allowing for sustainable operations. Furthermore, miners can benefit from professional maintenance and hardware upgrades that hosting services often provide.

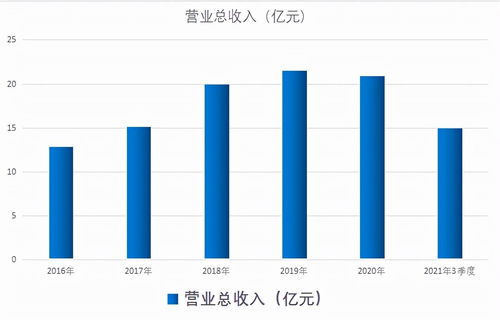

Nonetheless, miners need to recognize the costs associated with hosting. While the convenience of outsourcing can be alluring, proper evaluation of hosting fees against potential earnings is paramount. For example, when mining Dogecoin (DOGE), its generally lower overall network difficulty can sometimes lead to higher returns on a relatively smaller investment. With mining operations trending more toward decentralization, the choice between running a personal rig or utilizing a mining farm becomes a strategic decision based on individual goals and financial circumstances.

Understanding the market landscape, particularly how exchanges facilitate the buying and selling of mined cryptocurrencies, can be game-changing. Analyzing price trends enables miners to determine the best time to sell their coins. Crypto exchanges provide valuable insights into market liquidity and help establish a holding strategy. What’s more, diversification is key—by mining multiple cryptocurrencies, miners can hedge against market volatility.

Furthermore, staying informed about updates in the blockchain community is crucial. Participating in forums, subscribing to industry news, and engaging with other miners can present fresh ideas and strategies. Community feedback often brings critical insights that help miners optimize their tech stacks and adapt to market fluctuations. Joining a mining pool is another smart tactic—this approach mitigates the risks associated with solo mining, improves earning consistency, and facilitates access to advanced mining algorithms and resources.

Ultimately, the journey of mining cryptocurrencies involves a combination of technological savvy, market awareness, and strategic planning. Whether you’re operating a sleek rig in your basement or overseeing a colossal mining farm, the key to success lies in continual learning and adaptation. Remember, what works today might not secure profits tomorrow; hence, a proactive rather than a reactive approach is crucial in this fast-paced environment.

As we embrace the future of mining, one thing is clear: optimization is not merely a choice but a necessity in maximizing returns from mining ventures. Equip yourself with the right technology, remain informed about market dynamics, and you will position yourself to navigate the intricate pathways of cryptocurrency mining with confidence and skill. Happy mining!

A crucial guide! Demystifies crypto mining optimization, blending technology with profitability. Expect practical tips, not just theory, to maximize your crypto venture’s returns.