Beyond the Hype: A Strategic Guide to Procuring Genuine Bitcoin Mining Machines in 2025

As the world of cryptocurrencies continues to evolve, Bitcoin remains at the forefront of financial innovation. Entering 2025, potential investors and miners must navigate an increasingly complex landscape filled with both opportunities and pitfalls. The key to success in this exhilarating digital realm lies in procuring genuine Bitcoin mining machines that can withstand the test of time.

The surge in cryptocurrency prices, particularly Bitcoin’s meteoric rise, has led to a spike in demand for mining hardware. Unfortunately, this scenario has also opened the floodgates for counterfeit products and dubious vendors. The discerning buyer must remain vigilant, as understanding the nuances of mining rigs is essential for fostering a profitable operation. Factors such as hash rate, power consumption, and cooling systems play vital roles in the efficiency and profitability of any mining venture.

When considering the acquisition of Bitcoin mining machines, it’s crucial to tap into the community intelligence available online. Forums and social media platforms frequently showcase user experiences that can guide potential buyers. These treasures of information offer insights that can sometimes eclipse any product specifications provided by the manufacturers themselves. Beyond mere hype, real user feedback has the power to illuminate the path to legitimate and effective mining equipment.

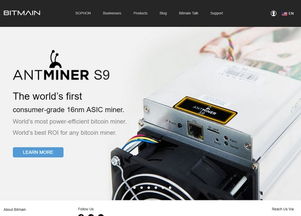

The ongoing battle between ASIC (Application-Specific Integrated Circuit) miners and GPU (Graphics Processing Unit) miners can add another layer of decision-making complexity. ASIC miners are often more efficient and provide higher hash rates tailored for specific cryptocurrencies like Bitcoin, while GPUs offer versatility for mining various altcoins, such as Ethereum. A balanced approach—considering both types—could diversify risk while maximizing returns.

Moreover, as the market continues to mature, companies are now offering hosting services that allow miners to deploy their machines in optimized environments. By utilizing a hosting service, miners can avoid costly overheads related to electricity, cooling, and maintenance associated with running a mining farm from home. This not only simplifies the logistics but also enhances profitability by minimizing downtime and leveraging economies of scale. The choice of hosting facility can significantly impact your mining yields, offering better infrastructure and management solutions than individual setups.

As an aspiring miner, it becomes increasingly necessary to stay attuned to regulatory frameworks shaping the mining landscape. Countries around the globe are beginning to establish clear guidelines for cryptocurrency operations. Embracing these regulations can ultimately pave the way for a more sustainable and ethical approach to mining. By adhering to localized laws, miners can avoid potential pitfalls, thereby fortifying their investments and ensuring long-term success.

The engagement with exchanges cannot be overlooked in this strategic guide. After all, successful mining serves little purpose without access to a reliable exchange where mined coins can be converted to fiat or other cryptocurrencies. Building relationships with exchanges and understanding the intricacies of trading platforms becomes vital. It’s essential to be aware of the fees, transaction times, and security measures in place—these can cause notable fluctuations in the final profitability of your mining efforts.

In addition to the technical and regulatory landscapes, an exploration of the broader ecosystem further enriches our understanding. The rise of decentralized finance (DeFi) has created intersections between mining, lending, and staking. This ecosystem provides innovative financial products directly linked to cryptocurrency protocols, and a savvy miner may find opportunities to leverage staked positions for additional capital gains. Such diversifications facilitate security against market volatility, creating a well-rounded investment portfolio.

Finally, nurturing a forward-looking mindset in this rapidly shifting market can enhance your resilience as an investor and miner alike. Continuous learning is paramount. Staying informed about advancements in mining technology, participating in communities, and adapting to market changes will provide miners with the advantage needed to thrive beyond the hype. Armed with knowledge and a well-thought-out approach, the dream of achieving financial freedom through Bitcoin mining can transition from merely aspirational to attainable.

Debunks mining myths! Forget quick riches, this guide offers savvy 2025 strategies for acquiring *real* Bitcoin miners. Think beyond the buzz; plan your profitable future.